Over 11% of American households own a recreational vehicle.

And being that we’re at the tail end of a worldwide pandemic, many Americans have turned to RV travel for their vacation plans this summer.

Since the onset of the pandemic, RV sales have skyrocketed in the United States. In 2021, it is estimated that there will be a 19.5% increase in RV sales.

And when you purchase an RV, you also need to purchase RV Insurance!

If you’re one of these new RV owners (or are thinking about buying one), you probably have questions about RV Insurance.

When new RV owners call me, they often have the same questions. Here is the list of the top five questions I get about RV insurance.

- Do I have to have insurance coverage on my RV?

- How much is my policy going to cost me?

- What does RV Insurance cover?

- Is coverage the same for an RV and a pull behind?

- Can I buy a policy that only covers my RV during the summer months when I travel?

1. Do I have to have insurance coverage on my RV?

If you can drive your RV, you are required by law to carry insurance coverage. Any vehicle licensed for road use has to have at least liability coverage.

If, however, your RV is towed by another vehicle, insurance coverage may be optional. For a tow behind camper, you will likely need coverage if you have a loan for your camper. If you tow your camper behind your vehicle, you may also be able to add it to your existing auto insurance policy.

And, I should note, the law does not require you to carry insurance for a recreational vehicle that you pull behind your vehicle.

However, without insurance in place, you are self-insuring your recreational vehicle.

You will have to pay out of your pocket for damages or face being unable to replace your tow-behind camper if something devastating happens to it.

2. How much is my policy likely to cost me?

So, what might you pay for RV insurance? The price of RV insurance is far-ranging. Here are two examples.

For an older RV valued at $10,000, you might expect to pay between $250 and $300 for insurance coverage.

For a more expensive motorhome valued at $250,000, you’re looking at premiums over $2,000.

The value of your RV will be the most significant factor in determining the cost of your policy. However, there are other variables.

Consider these questions.

- What state do you live in? RV insurance varies from state to state.

- Will your policy be based on the actual cash value of your RV or the replacement cost of your RV? Actual cash value will cost less than replacement cost.

- Who will be driving your RV, and how is their driving record? As with car insurance, the driving history and the drivers’ age will be a factor in determining cost.

- What type of RV are you insuring? If your RV is a traditional motorhome, it will cost more than a pull-behind camper.

- Which coverages will you include? As you will see below, RV insurance policies offer a variety of coverages. What you choose will impact your price.

- How often will you be using your RV? The more you use your RV, the more you will pay for insurance.

- Where will you store your RV? Keeping your RV on your property will cost a little less than storing it at a storage facility.

- How long is your RV? Longer RV’s cost more to insure than smaller RV’s.

3. What will my insurance policy cover?

RV Insurance is very similar to auto insurance. While every policy will include liability coverage, there are other coverages you can add to your policy.

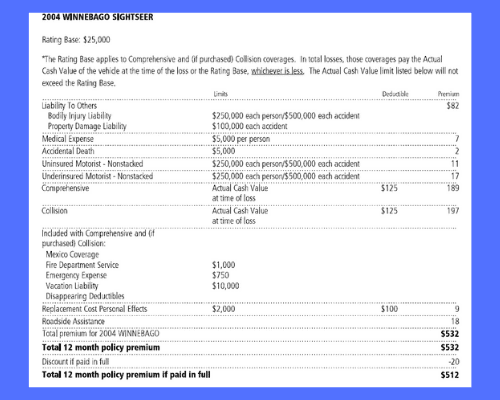

This is a sample RV Insurance policy. Your coverages and cost might vary some depending on your insurance company.

Liability

Liability coverage protects you if you hurt someone or damage someone else’s property while operating your RV. Every RV Insurance policy contains this coverage. This coverage includes two parts: property damage and bodily injury.

When you are purchasing your RV Insurance policy, you will determine what limits your insurance will pay if you are responsible for causing damage or bodily injury to someone else.

Your premium amount will go up as the limit amount goes up. And, you will have to set a limit amount both for property damage and for bodily injury.

If you don’t set your limit amount high enough and end up causing damage, you might be sued if your insurance cannot cover all of the damage you are responsible for.

Property Damage

If you drive your RV and cause any kind of property damage – running into a fence, knocking over a sign, hitting a vehicle – your liability coverage will help pay for any damage you caused.

Most people set their property damage limits at $100,000 per accident.

Bodily Injury

The other part of liability coverage is bodily injury. If you injure someone with your RV, bodily injury will cover medical expenses for those who were injured.

The limits for bodily injury are often set at $250,000 per person, with a $500,000 total limit for each accident.

Like property damage, you can opt for higher or lower limits.

It isn’t recommended to have limits under $250,000, however. Injuries from RV accidents can cost hundreds of thousands of dollars. If you do not have adequate coverage, you can be sued by those you injure.

Accidental Death

Accidental death coverage will provide a payout to your beneficiary or funeral home if any of the listed drivers on your policy or minor family members are killed in an RV accident.

The limit for this coverage is often set around $5,000 and usually costs less than $5 per year.

Underinsured Driver

Underinsured driver coverage, while not required, is highly recommended on your RV policy.

Unfortunately, many drivers on our roads only carry state minimums on their insurance policies. These minimums are often not enough to cover your medical expenses if you are in a serious accident.

Underinsured driver coverage will kick in to help you with medical costs if an underinsured driver hits you. We recommend you set your underinsured driver limits at $250,000 per person and up to $500,000 per accident for most of our clients.

The cost to add this important coverage will run between $10 and $15 per year.

Uninsured Driver

About one in eight drivers in the U.S. do not carry an adequate amount of liability insurance. Uninsured driver coverage will cover your medical expenses if an uninsured driver hits you.

We recommend that our clients set their limits at $250,000 per person up to $500,000 per accident for this coverage.

This coverage will likely cost between $15 and $20 per year.

Comprehensive

Comprehensive coverage for an RV covers damage done to your RV resulting from anything other than a collision. This would include fire, hail, windstorm, flooding, falling objects, vandalism, rioting, or contact with an animal.

If you have a loan with a bank for your RV, they will require this coverage.

You will need to choose a deductible amount for this coverage. Your deductible amount can range from $100 up to $2,500.

Collision

Collision coverage for your RV covers any damage done to your RV resulting from a collision that you caused.

Again, if you have a loan for your RV, your lender will require this coverage.

You will also determine your deductible amount for collision coverage in the 0same amounts as comprehensive coverage – from $100 up to $2,500.

Vacation Liability

Vacation liability is a coverage unique to RV insurance. This coverage will protect you if someone gets hurt in your space while your RV is not parked at your home.

For instance, if you park at a campground and someone walks into your awning and is injured, vacation liability will protect you if you get sued. Another example would be someone tripping over firewood in your campsite and getting burned. That accident would be covered by vacation liability coverage.

Emergency Coverage

Emergency coverage protects you if you need emergency help while traveling. This will cover costs related to towing or an unexpected stay in a hotel if your RV breaks down.

Personal Property Coverage

Personal property coverage will protect the items you are carrying in your RV.

Let’s say you are parked at a campground and go out for a bite to eat. While you are gone, someone breaks into your RV and steals several electronic items. You could file a claim under your personal property coverage.

Another example might be if you have a fire in your RV that destroys your personal property. Personal property would pay up to the limit amount for your lost property.

The amount you will pay for this coverage will depend on your limit amount. In general, this coverage is relatively inexpensive. For instance, on a policy I recently wrote, the insured set a $2,000 limit and only paid $9 for the coverage.

Other Coverages

Additional coverages may be available depending on the insurance company that is writing your policy. Your agent should ask you about any extra coverages when you contact them for a quote.

4. Is the coverage the same for a traditional motorhome and a pull-behind camper?

In general, the coverage is the same for both traditional motorhomes and pull-behind campers.

One major difference between traditional motorhomes and pull-behind campers is this:

Traditional motorhomes always require their own insurance policy.

You can often add pull-behind campers to your existing auto insurance policy.

If you have a pull-behind camper, your insurance agent can counsel you on the best option for your recreational vehicle.

5. Can I buy a policy that only covers my RV during the summer months when I travel?

No. You can not buy a policy that only covers your RV during the summer months. You can, however, tell your agent how much you will be using your RV.

Insurance companies will set your premium amounts based on the usage your RV will be getting.

So, if you will be living in your RV as your permanent home, your insurance will be higher than if you are only using it for three or four weekends during the summer months.

I’d like to check on RV Insurance. What do I do next?

If you would like to check on the cost of RV insurance, you can give a call to our office any weekday, and our team will be available to price out a policy for you.

In addition, if you are thinking about buying an RV, you can call our office to get an idea of what you will be looking to spend each year on insurance for your “home on wheels.”

Our team members have many companies that we work with to write coverage for recreational vehicles and can provide you with multiple quotes. This way, you can find a policy that best meets your needs at the best price.

To get started on a quote today, you can give us a call at 724-627-6121.

We want to make sure you’re protected before you hit the road!