In 2020, we approached Hranec Corp. to inquire about engaging them in our blueprint process – the process we use to help our clients and prospective clients get an in-depth analysis of their current insurance and risk management program.

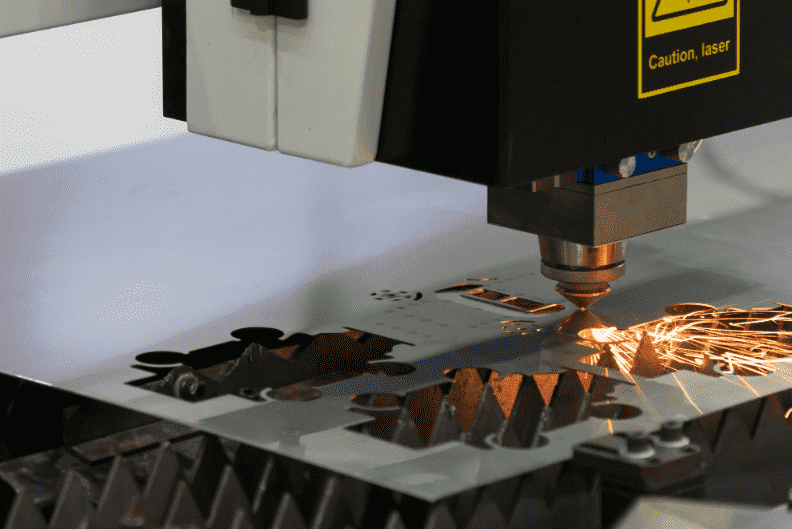

Hranec Corp. is a mechanical construction and fabrication company located in Uniontown, PA. They have an excellent safety record. And as you can imagine, a lot of insurance agents give them a call close to their renewal time.

When we called, Hranec Corp. was already leaning toward moving their insurance to another agent.

So, before renewing, we met up with Steve Hranec, owner of Hranec Corp., and Dave Pocratsky, Corporate Vice President, for an initial 15-minute meeting.

At this meeting, we learned that the Hranec Corp. team had already whittled down the list to four other insurance agents to quote their insurance.

Their question was how do we cut through all the BS and determine which one really had the best option. They were hunting for a team that could bring them the best coverage at the best price.

After hearing this, we knew that it would not be in their best interest to have yet another agent quoting their insurance. Adding another quoting agent would only muddy the water of their insurance buying process.

In reality, even four agents were already too many, and they all wanted to go to the same insurance companies.

But during that 15-minute meeting, it also became clear that Hranec Corp. needed to address some issues in their insurance program. And even though it wouldn’t be in their best interest for us to quote their insurance, Hranec Corp. saw value in moving through our blueprint process.

Our blueprint process is a thorough analysis of a business’s current insurance program. Through it, we help our clients create a long-term insurance program based on what they want and need rather than what their insurance agent/insurance company wants to sell them.

Hranec Corp. wanted to eliminate their insurance gaps based on their risk tolerance and effectively lower their insurance premium costs simultaneously.

As we talked that day with Mr. Hranec and Mr. Pocratsky, it became clear that they had four main questions regarding their insurance renewal:

- How do we know what we’re really getting?

- What are our insurance needs?

- Which agent should we trust?

- Is there a way to simplify this tedious process?

Hranec Corp.’s Concerns

Essentially, Hranec Corp.’s four main concerns were about integrity in the insurance quoting process-concerns that many businesses have when comparing quotes from different agents.

They wanted to be confident that they were getting everything they needed, that their agent was honest (and knowledgeable), and that they were getting the absolute best possible price.

1. How do we know what we are really getting?

A big concern for Mr. Pocratsky was understanding the fine print of their insurance quotes. Comparing insurance policies is often more like comparing apples to oranges instead of apples to apples.

Policies are incredibly nuanced and have a ton of variation!

And insurance is incredibly confusing! The language used in policies is very specific and can be hard to interpret even if you are a trained insurance professional.

Most businesses depend on their agent to interpret what exactly their policy will cover and what it will exclude. So, having a very knowledgeable and trustworthy agent is essential!

As the Hranec Corp. team was presented with multiple insurance quotes, it became confusing!

As their consultant, we gave all the quoting agents the exact specifications that Hranec Corp. wanted. Even so, these agents ALL came back with proposals that contained numerous variations and differences in the fine print.

And even though we had communicated Hranec Corp.’s desires, none of these agents came back with what we actually told them Hranec Corp. wanted.

Outside of taking a graduate-level insurance class or spending hundreds of hours looking up insurance terminology, it was virtually impossible for Mr. Pocratsky to understand how one policy differs from another.

As Dave commented, “I’m an expert at sheet metal.” Dave knows the language of mechanical contracting and sheet metal. He has the tools to evaluate fabrication and years of experience to have become an expert in his field.

And while he has worked with insurance agents for years in his role at Hranec Corp., Dave also acknowledges that insurance has its own nuanced language. He said, “Not knowing the language makes you susceptible.” And he is 100% right.

2. What are our insurance needs?

The next issue, Hranec Corp. was up against was thoroughly assessing their insurance needs.

In insurance, each insurance agent who is giving a quote needs to understand your business’s particulars. Just like no two fingerprints are the same, no two companies are the same.

As a manufacturing firm, Hranec Corp. needs certain coverages and endorsements to ensure there are no gaps in their coverage. Without an intimate knowledge of the manufacturing world, it would be difficult for an insurance agent to make sure that they had all of the coverage they need.

One of Hranec Corp.’s biggest concerns was finding an agent who had the expertise to write their commercial insurance package and help them manage their risk.

They wanted to know that if they did their part to implement best practices, their agent would consistently deliver a great-priced product and continue to provide expert advice.

3. Which agent should we trust?

This leads to their third concern. With four insurance agents in the game, how could they know which agent to trust?

All four of these insurance agents were claiming that they were the best choice. What measure could Hranec Corp. use to know which agent really would be the best agent to write their policy?

Without expertise in insurance AND risk management, choosing the most qualified insurance agent was like taking a shot in the dark. Without guidance, the Hranec Corp. team would have to rely on their gut instincts and impressions of the agents who provided quotes.

4. Is there a way to simplify this tedious process?

And lastly, for Hranec Corp., the insurance quoting process is always time-consuming!

And with more agents working on a quote, Hranec Corp. needed to gather a lot of information for each agent.

Assigning agents

They also needed help deciding which agents were given access to which insurance companies. Most insurance companies ask that you assign one agent to work with them by writing a broker of record letter. For Hranec Corp., this would be an important decision.

Why?

Because in commercial insurance, each insurance company will only receive one application for your business.

And once an agent applies on your behalf to an insurance company, no other agent will be permitted to apply to that company for you for an entire year. Every other agent is blocked from applying on your behalf, and you will just be stuck with the first quote.

This meant that Hranec Corp. needed to thoughtfully assign which agent to apply on their behalf with each insurance company. This is an art in and of itself because not every agent can get the best quote from each company.

Choosing which agent to ask to apply to each company on their behalf required research. Hranec Corp. didn’t even know how to go about this process. But, as an insurance agency, we knew how to make this assessment and could help them make an informed decision about assigning the various agents.

Comparing quotes

After gathering the necessary information and assigning insurance agents to apply to the various insurance companies, Hranec Corp. would need to compare the various quotes they received.

As I mentioned above, wading through the specific insurance language was daunting, if not impossible, for those who are not experts!

It would take the Hranec Corp. team an enormous amount of time to understand what each policy was offering and make sure no coverages or endorsements were overlooked.

In the end, Hranec Corp. would have to spend hours collecting information, researching which agents to assign to which insurance companies, and scrutinizing complicated policies to determine their best option.

Engaging with Baily Insurance

While Baily Insurance Agency writes commercial insurance, Hranec Corp. found it more beneficial to utilize our insurance expertise to apply our “inside” information to leverage on their behalf as their consultant.

Together we settled on the scope of work that we would do for their company. We would focus on making sure their applications represented their desires, communicating with the quoting agents, and evaluating the proposals they received.

So how did we do this? Here is a quick overview:

- We completed a thorough analysis of their insurance and risk management needs.

- We communicated with the quoting agents on Hranec Corp.’s behalf throughout the quoting process.

- We also sifted through each proposal and identified areas of strengths and weaknesses of each proposal.

- We made recommendations to help the Hranec Corp. team arrive at their final decision.

1. Analyzing Hranec Corp.’s insurance needs

Baily Insurance’s first step when engaging with the Hranec Corp. team was guiding them through our blueprint process.

Using this tool, we assessed their coverages and exposures, claims management, HR and Safety practices, and a few other factors to determine what Hranec Corp. needed in their insurance package and what they would need from their agent.

Through this process, we found gaps in their current insurance program that needed to be rectified.

After completing our analysis, we provided the Hranec Corp. team with a report on our findings about their coverages. We gave them recommendations on improvements their insurance and risk management program needed.

Then, we helped Hranec Corp. communicate exactly what insurance coverages we wanted to be included in each of the quoting agents’ proposals.

This simplified the process and guaranteed that evaluating the proposals would be closer to comparing apples to apples (at least granny smith’s to macintosh instead of apples to oranges).

2. Communicating with the agents

Baily Insurance Agency simplified the insurance buying process and increased consistency in their insurance proposals as their consultant.

Dave commented, “Getting everything ready for our insurance quote takes a long time. It was nice to have help with this process.”

Because Baily Insurance writes insurance for other fabrication companies, we knew just what needed to be included in the applications. As the consultant, we prepared applications that each quoting agent used to prepare their proposal.

This ensured consistency in the proposals Hranec Corp. received.

Having a consultant also seemed to surprise the quoting agents. The agents knew that our team would be able to explain everything to the Hranec Corp. decision-makers.

And we helped minimize the time wasted by the agents. Because we spoke the same language and took the time to understand Hranec Corp.’s needs, we could eliminate some of the typical miscommunication between customer and agent that inevitably happens in the quoting process.

By engaging Baily as a consultant, Hranec Corp. also had confidence that our team could assess if each agent presented excellent coverage at a fair price.

3. Evaluating each proposal

By the time it was all said and done, Hranec Corp. had ten different proposals to consider. Each of these proposals had variations and hundreds of potential options from which to choose.

As their consultant, we thoroughly assessed the proposals Hranec Corp. received. With our expertise in writing fabrication policies, we scoured the language of the policies.

After comparing each proposal, our team sat down with Mr. Hranec and Mr. Pocratsky to clarify their options.

“The Baily team could really explain the process,” Mr. Pocratsky noted. We helped with one of their biggest concerns, “knowing and understanding the coverages.”

We were also able to help explain each agent’s various options and help them understand real-world claim scenarios to determine if the coverages were appropriate for them or just a waste of money.

To bring the process to a close, our team gave recommendations on the packages that would provide the best coverage at the best price.

4. Making the final decision.

In the end, we narrowed the decision to two finalist agents. Working with those agents, we helped design an insurance package that would give Hranec Corp. all of the coverages they needed.

We also advised them on the policy that provided the best coverage at the best price.

We brought transparency about compensation for the agent and clarity about what was actually being offered. Hranec Corp. was able to confidently move forward, knowing that they were truly getting the best possible product (agent and company and services) at the best possible price.

In the end, after the decision was made, I called Dave and asked him if he was surprised by the result. His reply, “I think we did good!”

It was a simple but rewarding response because he was 100% right!

Working with a Consultant to Simplify the Insurance Process

By having a team of insurance experts on their side, Hranec Corp. was able to simplify their insurance buying process. Our team streamlined the application process guaranteeing that the proposals they received would be easier to compare and evaluate.

Hranec Corp. was very pleased with the results the Baily team was able to bring to their insurance buying process this year.

According to Mr. Pocratsky, “It was a good experience. Baily made the process easier. We walked away with better coverages and savings on our insurance. They simplified the whole process.” In fact, they walked away with more than $35,000 in savings!

At Baily Insurance, our main priority is to bring value to the clients we serve. With Hranec Corp., we knew that adding another agent to the quoting process would slow things down and add even more confusion.

Has your commercial insurance quoting process been tedious, confusing, stressful, or time-consuming?

You might also benefit from having someone come alongside you and make this challenging process a lot easier!

Without switching agents, our team will:

- Work with your company and create a detailed analysis of your current insurance program

- Identify areas of strengths and weaknesses in your current insurance package

- Recommend what coverages and endorsements you need to eliminate gaps in your insurance program

- Assist you with the quoting process to “level the playing” field for those agents who are competing for your business

- Communicate what you want and expect from your insurance proposals

- Advise you on which policy meets your expectations and standards

- Evaluate the pricing of each proposal

At Baily Insurance, we’re committed to our clients! As your agent or consultant, our priority is helping you get the best insurance package at the best price!

Related Articles:

4 Keys to Finding the Best Commercial Insurance Agent

How a Borough Saved $80,000 and Reduced Their Insurance Premiums