My kids really like to play the game Risk. You know the game where the players gather armies and then roll some dice to attack one another.

It’s fun to watch my kids and see how they approach the game so differently. My son likes to gather his armies in a country and will only go to battle if he thinks winning is a “sure thing.”

My daughter, on the other hand, might be considered reckless! With a few armies in a country, she’s all in for a battle! Even if she loses everything, she thinks challenging her opponent is worth the risk.

Deductibles are like a game of risk. In this game, you decide how much you’re willing to risk having to pay toward an auto insurance claim before the insurance company kicks in their portion.

And like my kids playing the board game, everyone approaches how they set their deductibles differently.

Some people are conservative and want to take on a little risk. Others are willing to risk a significant loss.

But for both, the risk needs to be well-thought-out. Having a high deductible will mean you have to pay a significant portion out-of-pocket. Can you do that?

Auto deductibles are a matter of personal choice and personal responsibility.

So what should you choose for your deductible amounts?

In this article, we will answer that very question. And we’ll also answer:

- What coverages do you need to set deductibles for?

- How does a car loan or lease affect your deductibles?

- What are the most common deductible amounts?

- How much will high deductibles save on premium amounts?

- What do you need to consider when setting your deductibles?

What coverages do you need to set deductibles for?

With an auto insurance policy, you will need to set deductibles for your comprehensive and collision coverage. You might also need to set a deductible for glass coverage.

What you will not need to set a deductible for is your liability coverage. Liability coverage has no deductibles. Liability coverage protects anyone whose property is damaged because of an accident you caused.

Deductibles for Comprehensive and Collision Coverage

If you purchase an auto insurance policy with comprehensive or collision coverage, you will need to set deduction amounts for these coverages.

So what is comprehensive and collision coverage?

Comprehensive coverage allows you to file a claim if something damages your car other than a collision with another vehicle.

Comprehensive covers:

- Glass breakage

- Fire

- Theft

- Vandalism

- Falling objects

- Civil disturbances

- Natural disasters

- Damage from animals

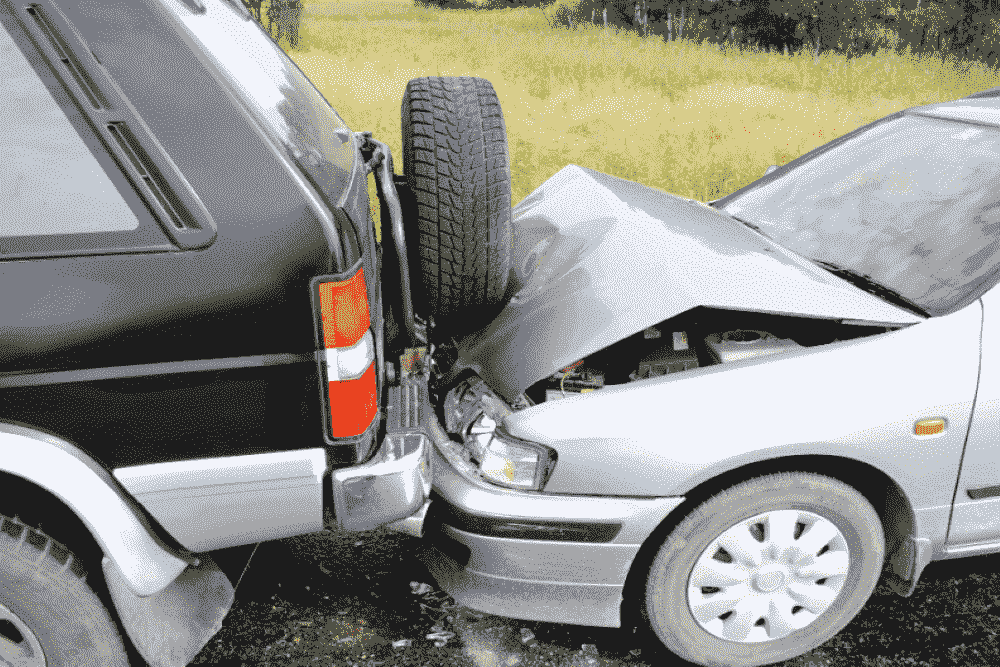

Collision coverage covers you if your car is damaged in an accident that you cause. This will kick in if you hit a moving vehicle, a parked car, a fence post, a telephone pole, or anything else.

When you have comprehensive or collision coverage, the insurance company will require you to set a deductible for each of those coverages. You can set a deductible as low as $0 or as high as $2,500.

Lower deductibles will mean a higher premium. And higher deductibles will lower your premium.

But premium cost should not be the deciding factor for setting your deductibles. Your financial situation should be the determining factor.

Glass Deductibles

Often auto insurance companies will offer a separate deductible for glass on your policy. This would mean that if the only damage done to your vehicle was to your windows you would pay the glass deductible and not the full comprehensive deductible.

And, windows can be costly to replace!

Not long ago, my co-worker needed to replace their Toyota minivan’s windshield. The replacement window was going to cost $299.

And while most people don’t have to replace their windshield very often, when it does happen, you can expect it to be expensive!

Fortunately for that coworker, they had a glass deductible on their policy. They only had to pay $50 to replace the window instead of the $299.

In total, they paid around $30 per year for that coverage. They preferred to pay the $30 per year along with their $50 deductible, instead of forking out $300 all at once if something happened to their windows.

How does a car loan or lease affect your deductibles?

If you do not own your car outright, your bank or lender will require you to have both comprehensive and collision coverage on your auto policy.

That’s not all. They will also have requirements as to how high you can set your deductibles.

For most lenders, your deductibles can be set no higher than $500.

Why is this?

Your lender wants to know that damage will be covered on your car since they still technically own part of your vehicle. Until you pay it off, they will have specific terms regarding your deductibles.

What are the most common deductible amounts?

Like I said earlier, setting deductibles is a personal decision. However, most of my customers set their deductibles as follows:

For comprehensive – $250 or $500

For collision – $500

If you set a high deductible, you are essentially self-insuring your automobile. You will end up paying out of pocket what the insurance company would pay to have your car fixed.

Most of my customers feel confident that they will be able to cover between $250 and $500 if their car ends up with major damage from an accident.

How much will high deductibles save on premium amounts?

The reason most people set higher deductibles is to save money on their auto insurance premiums.

As I said earlier, the higher the deductible, the lower the premium.

Collision Deductibles

Let’s take a real example of what you can expect to save if you raise your deductibles.

Let’s see what happens when we play around with raising the collision deductible on this policy.

|

Original Deductibles |

Increased Deductibles |

||

| Comprehensive | $100 | $100 | $100 |

| Collision | $500 | $1000 | $2500 |

| Glass Coverage | Full Coverage | Full Coverage | Full Coverage |

| Savings | $122 per year | $208 per year | |

As you can see, there are significant savings as you raise your deductible. At the same time, you are also taking on much more substantial risk.

You have to decide. Is saving $208 on this policy worth the risk of having to pay out $2500 for repairs if you cause an accident.

Bumper damage, a large scratch on your paint job, or replacing a damaged car door can all cost thousands of dollars. With a high deductible, you need to be prepared to pay for those repairs yourself if you hit something.

Comprehensive Deductibles

Now let’s play around with raising comprehensive deductibles.

Remember, comprehensive coverage protects you if something non-collision-related happens to your car, like a deer running into it or a tree falling on it.

Let’s see how much this policy will save just by raising the comprehensive deductible amounts.

| Original Deductibles | Increased Deductibles | ||

| Comprehensive | $100 | $500 | $2500 |

| Collision | $500 | $500 | $500 |

| Glass Coverage | Full Coverage | Full Coverage | Full Coverage |

| Savings | $52 | $138 | |

Again, as with the collision deductible above, you have to decide if you would prefer to save $138 this year on your policy and risk having to pay up to $2,500 to fix non-collision-related damage.

What do you need to consider when setting your deductibles?

This brings us to the real question we set out to answer in this article.

What should you choose for your deductible amounts?

Determining your deductibles is a personal decision. There is no hard and fast rule for each person.

However, every person does need to answer these same questions when they choose their deductibles.

1. How much can you afford to pay for your auto insurance policy?

One crucial factor to consider is how much you can afford to pay for auto insurance. As demonstrated above, raising deductible amounts will change the premium amount you have to pay. Your insurance agent can give you several quotes to compare how the premium rates vary when you raise or lower a deductible.

2. What can you afford to pay out of pocket for an auto claim?

If you have an accident or if something happens to your vehicle, you don’t want to wait to have it repaired. When you consider your monthly bills and your monthly income, can you pay for repairs out of pocket? How much extra do you have available to put toward a deductible?

3. How much do you have currently in your savings?

Your savings can heavily influence the amount you can pay toward a deductible. Again, you don’t want to wait to save up enough money to pay the repair shop your portion before having your car fixed.

4. How expensive is your car to fix?

The costs to fix a car are often dependent on the vehicle’s age and the car’s make. It may be more challenging with older or more expensive cars to find the parts needed for a repair. This is something you should keep in mind as you set your deductibles. Remember that fixing a 2020 Kia is going to cost less than a 2020 Lexxus.

5. How old are your drivers?

If you have youthful drivers (under the age of 25) or older drivers on your policy, you may want to have your insurance agent check on what your policy would cost with higher deductibles. Policies that cover youthful and older drivers are generally more expensive. Playing with your deductible amounts may help you find a more reasonable price for your auto policy.

6. How much are you willing to pay for peace of mind?

For many individuals, peace of mind is worth a little extra cash. Knowing that your car is fully covered and that you won’t have to face a considerable expense to repair it is the peace of mind that many people want to have. How much risk do you want to take? How important is it to you that you not have a large unexpected expense?

Are you looking for an auto insurance quote?

It’s no secret that you can quickly get an auto insurance quote online. What you can’t get online is the personal service that an independent insurance agent can offer you.

When our insurance team writes a new insurance policy, we take the time needed to lay out everything you need to consider before settling on a policy.

We help you think through your needs, and we work hard to get a policy that meets those needs. We know the insurance companies we work with, we know what they have to offer, and we know which companies would be an excellent fit for you!

Insurance is a very personal decision – it’s definitely not a one-size-fits-all product!

If you are looking for an insurance team that puts their clients’ needs first, look no further! We’re waiting to help you!

Related Articles:

Unseen Costs of Cheap Auto Insurance (Is It a Bargain?)

Top 10 Auto Insurance Companies (Travelers, Progressive, Geico, State Farm, and More)