Does my insurance cover riots?

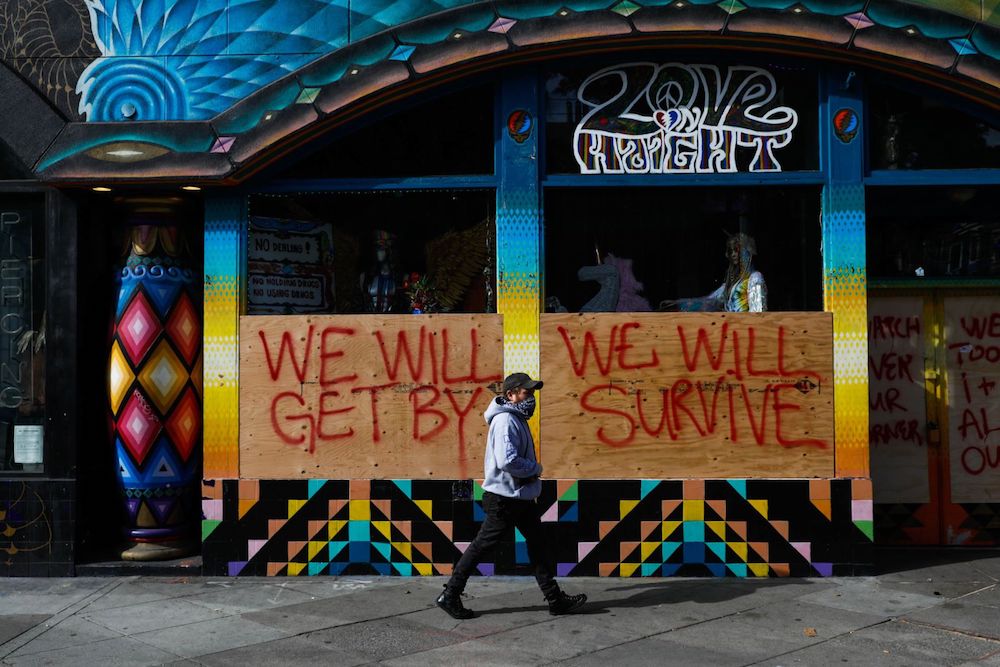

Many of the accounts I service are in areas where recent rioting has occurred. Somewhat panicked, people have called me to ask if their insurance will cover damage from rioting or vandalism. The honest answer is, “It depends.”

In this article, I will address various insurance coverages – personal and commercial – that would likely apply in response to a riot or vandalism claim as well as a couple of gaps that you may have in your policy. Because insurance is a complicated business, it’s important to note that your specific situation or policy might also impact what is or is not covered.

That being said, there are some generalities in what most policies cover. These include:

- Automobiles

- Buildings

- Personal Property

- Living Expenses

- Loss of Income

- Extra Expenses to Reopen a Business

Automobiles

Comprehensive Coverage

“Comprehensive” coverage generally covers any damage that occurs to your vehicle not due to a collision. You might find this labeled on your policy as “Other Than Collision.”

With this type of policy, you would find coverage for claims such as:

- Fire

- Flood

- Hit and run

- Theft

- Falling objects such as a tree or something thrown from a balcony or pedestrian

- Broken windshields Some companies even offer glass coverage without a deductible!

- Graffiti from vandalism or rioting

- As well as the more common hitting a deer or other animal on the road are generally all covered under this line of coverage.

Just as all the above scenarios fall under this coverage, any physical damage will be covered whether caused by riots or otherwise.

“Liability Only” Coverage

Unfortunately, approximately 25% of the population does not have “Comprehensive” coverage as part of their auto insurance policy. These policyholders have “Liability Only” coverage.

This coverage only provides protection for damage you do to others – both property damage and/or bodily injury. This also means that 25% of all auto policies will not cover any damage caused by fire, falling objects, vandalism, or rioting.

Buildings

Homes, buildings, and the stuff inside them, all fall into the category of property insurance. Similar to auto insurance policies, property insurance policies cover damage to property caused by vandalism, fires, or theft. This also would include damage caused by rioting.

For any buildings on your policy, your coverage should include any damage to the following:

- Windows

- Doors

- Light fixtures

- Attached fences

- Other fixed property that is part of a building.

Personal property

Business Personal Property (BPP on a commercial property) or Personal Property coverage will generally cover anything on your property that is not permanently installed. For example, if you use your imagination and turn your house or building upside down, everything that just went flying is BPP or Personal Property.

- Furniture, appliances, food, dishes, clothes, computers, art, etc. all need to be included in that coverage limit for your home.

- Additionally, any equipment that is not permanently installed, merchandise, inventory, etc. should also be included in that coverage limit for your business.

There are, however, some limitations to these policies if a property is considered vacant or unoccupied.

Living Expenses

One additional coverage included in your home, business, or personal property insurance policy is coverage for living expenses if your property is deemed unlivable or unusable. In this instance, your standard home and renter’s insurance policies provide coverage for “additional living expenses.”

What does this cover?

“Additional living expenses” coverage pays any costs associated with living away from home.

- Hotel bills

- Restaurant meals

- Other expenses incurred while your home is being repaired or rebuilt.

If your home or apartment building was damaged due to rioting, you may not be able to live there currently. If this is the case, your insurance may cover your expenses until you are able to live in your home again.

Lost Income

You may also lose income if your business is forced to shut down because of civil unrest, civil authorities needing to take control of your property or an adjacent property, or government policies requiring a temporary closure.

When applying for a commercial business policy, coverage for a loss of income should always be evaluated.

So what is covered if your business is forced to close and you lose important business income?

If your business sustains damage due to fire, explosion, demolition, etc., there is likely to be coverage in your policy for your loss of income. In the insurance world, we would say that one of these occurrences “triggered” additional coverages including coverage for your lost income.

Some policies include the term “Actual Loss Sustained” which will cover your “actual loss” of income (generally the profit) if your business cannot reopen, or the extra expenses needed to get you reopened again in a timely manner. This coverage is typically limited to 12 months of lost income or the time to rebuild. This is not always adequate, but generally, this is pretty good coverage to have.

Business income insurance, also known as business interruption, will cover the loss of income for businesses that are being forced to suspend operations or have limited hours due property damage resulting from rioting, vandalism, or civil commotion.

Business income coverage most often has a waiting period of 72 hours. The waiting period applies to any income losses, including those insured under civil authority coverage, and does not apply to extra expense losses.

Some policies will have a specific lost income limit or specific timeframe for the payout. You will want to consult with your agent about how your policy will specifically respond based on your needs and situation.

Extra Expenses to Reopen A Business

What if you do have “extra expenses” as you prepare to reopen or relocate? What might your policy cover?

Generally, your coverage for “extra expenses” will include:

- Expedited cleaning services need to reopen

- Internet at a new location

- Moving costs to get up and running at a new location

- Additional cost to expedite the replacement of stock or equipment

- And sometimes even additional cost to switch vendors who are shut down by a covered loss

Potential Problems or Gaps in Coverage

Insurance is a field in which there are exceptions and exceptions to the exceptions. Often there are clauses included in an insurance policy that might create a gap in your coverage. The best way to make sure you are properly covered is by speaking with your agent and reviewing your policy.

Below are two exceptions that you might want to inquire about if you need to file a claim.

COVID-19 Complications

Tragically, these riots are coming on the heels of COVID-19 and will potentially create a catastrophic combination for businesses. After being closed for weeks on end, businesses may have little to no revenue to replace and, as a result, little to no coverage.

The potential problem is that because most companies have been closed due to COVID-19 that at the time of the claim, there was a $0 revenue. This means there would not be any Business income loss to claim.

Civil Unrest

Civil authorities can bar you from entering your business in situations that are not related to protests, riots, or civil unrest. If the riots continue to where the National Guard comes in, then there could be gaps in your coverage.

Civil Authority taking control could lead to an exception in the policy where war is excluded. Ultimately, it will all depend on how all of this gets defined and right now there are a lot of ifs. Policyholders must find out what their policy covers and how to prepare for unforeseen situations properly.

How Can I Know If I’m Covered?

Meeting with a licensed insurance agent to discuss your policies’ limits and coverage is the only way to be certain you are covered when something unexpected happens. Taking the time to thoroughly examine your assets and needs is essential in building a policy to protect you when you need it most.

We have an incredible staff at Baily Insurance dedicated to helping our clients navigate these uncertain times. Our staff is available to answer any questions you have about your policy and to assist you in making sure that your auto, home, or business are protected. Let us work with you to find the type of coverage that best meets your needs.

If you are looking for a licensed agent to partner with you, please contact us for a consultation.